This post is brought to you by our advertising partner, Invictus Capital.

Currently, global macroeconomic indicators point to both bearish crypto and equity markets. Inflation in the US is at 7.5%, the highest level since the 1980s — and contrary to the narrative of Bitcoin as an inflation hedge, the incoming attempt to control inflation from the Fed through tapering of asset purchases and interest rate hikes is weighing heavily on sentiment.

In addition, Russia has launched a full invasion into Ukraine. Russian troops and tanks moved into Ukraine and airstrikes hit the country’s capital and a dozen other cities early Thursday. The UK and USA have imposed sanctions on Russian banks and high net worth individuals and Germany has paused the approval process of the Nord Stream 2 gas pipeline project. NATO is expected to join the Ukrainian side, and the People’s Republic of China is expected to back Russia both diplomatically and financially. This pending clash of global superpowers in Eastern Europe, coupled with the unknown effect of the ongoing Covid-19 variants and tighter US monetary policy, make for a concerningly bearish economic landscape.

However, the global economy continues to emerge from the economic slump caused by the Covid-19 pandemic. The majority of countries in Europe and North America have decided to relax Covid restrictions, with the UK recently announcing a total removal of restrictions, including the requirement for self-isolation after a positive test. We can expect the removal of such restrictions to boost travel, business and the functioning of economies.

Clearly, uncertainty is prevalent amongst investors worldwide. Holding the correct portfolio and timing the market is crucial in these uncertain times. Looking at evidence from US markets in previous bear markets, it is evident that index funds have outperformed most actively managed portfolios. But unlike in equity markets where index funds are ubiquitous, crypto investors are forced to choose from a small basket of alternatives, which often follow a strategy of market capitalisation weighting — leading to concentrated portfolios. An attractive “smart” crypto index fund is Crypto10 Hedged (C10), offered by a leading firm in the crypto asset management industry, Invictus Capital.

The crypto market boomed in 2021, stimulated by an influx of new retail investors and the real-world application of blockchain technology becoming increasingly apparent. Extraordinary returns and exponential growth of users in the crypto space piqued the interest of institutions with traditional financial giants such as JP Morgan, Van Eck and Blackrock beginning to offer crypto products and utilise blockchain technologies to streamline their operations.

Institutions like these have the capital, influence and investor base to revolutionise the crypto industry completely and are only interested in use-case cryptos. Use-case cryptocurrencies are tokens that have useful technology behind them, such as clever smart contracts or fast and cheap networks that institutions can use on a daily basis to lower their costs and enhance the user experience for their clients.

With the wide range of underlying technologies and the constantly changing landscape, figuring out which crypto will become the next game changer is extremely difficult. This is why crypto index funds are becoming popular amongst investors who want the benefits of diversification while having constant exposure to blue-chip projects. Suppose a project fails for any reason or gets surpassed by better projects. In that case, it will be dropped from the index fund, ensuring that investors constantly hold the most valuable coins.

C10 is the optimal crypto index fund designed to identify downturns as they occur. C10 is a tokenized index fund that serves as an excellent diversification tool for those interested in adding cryptocurrency to their portfolios. In markets as volatile and fast-paced as crypto, a dynamic cash hedge is invaluable to effectively minimise the downside risk in times of heightened market uncertainty.

C10 is driven by a proprietary algorithm, optimised to protect from loss of capital during market downturns by increasing cash holdings in bear markets, and when volatility spikes. This is done by simply converting a portion of the fund’s crypto assets into cash and consequently re-allocating to crypto at a later stage as the market recovers. Invictus Capital’s C10 fund is rebalanced weekly — a frequency that allows for a responsive cash allocation by frequently updating the data that determines the algorithm’s cash allocation, but not so frequent as to result in overtrading and incurring the associated transaction fees.

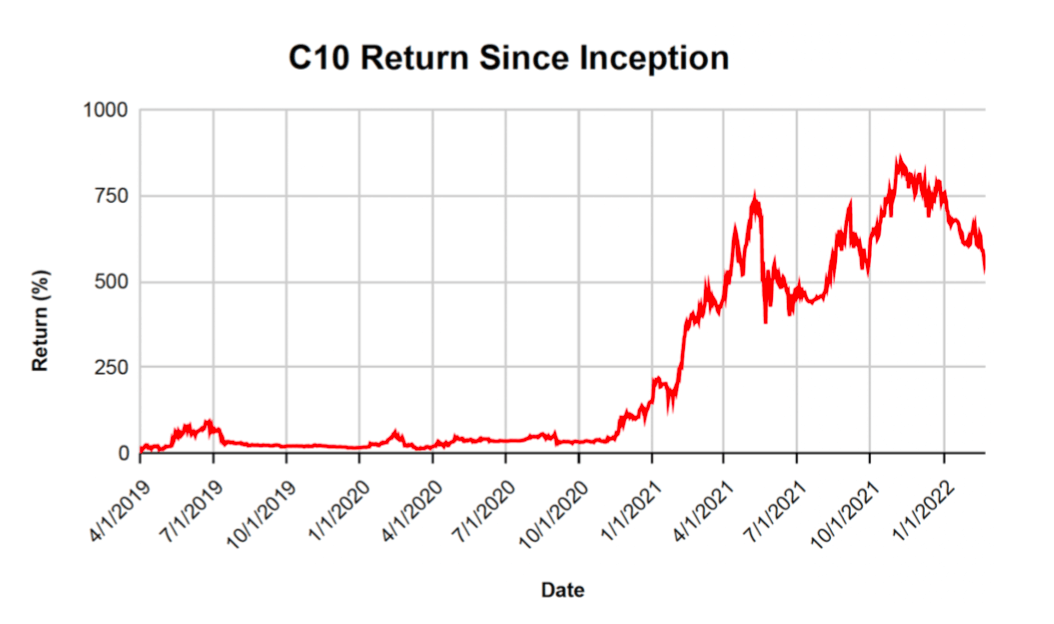

The C10 fund has a history of strong performance, over the last quarter of 2021 the fund offered a 23.91% performance, far outperforming its benchmarks return of 1.66% and BTC’s return of 12.36%. In Q1 of 2020, Bitcoin dropped over 10%, with altcoins across the board being hit much harder. Crypto10 masterfully navigated this volatile trading environment to grow 1.26% over this period. Over March 12 — arguably the quarter’s defining moment with Bitcoin collapsing 40% — C10 held over 90% of the fund’s assets in cash.

The C10 fund offered exceptional returns over the quarter at 23.91%, far outstripping its benchmark of 1.66% and Bitcoin at 12.36%. This shows the ability of C10 to preserve capital during drawdown events through its dynamic cash hedge and subsequently capitalise on upward trends by reallocating into crypto exposure. The severe downside deviation witnessed in the markets at the start of December was largely hedged by the fund, allowing investors peace of mind through the market turmoil.

The C10 fund provides significant capital protection during market downturns, allowing for a greater amount of capital to participate in market recoveries. During bull runs, C10 offers increased exposure to the top 10 crypto assets by market cap, giving holders the added benefit of significant diversification alongside diminished downside volatility.

With crypto prices currently suppressed, investors are provided an excellent opportunity to enter the C10 fund at an attractive price.

The post Investing in an intelligent crypto index fund — built for all market environments appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/JkAUhWg

via IFTTT