Bitcoin (BTC) dropped below two psychological price barriers — $30,000 and $29,000 — in the last 24 hours to liquidate $66.14 million long positions held on the asset, according to Coinglass data.

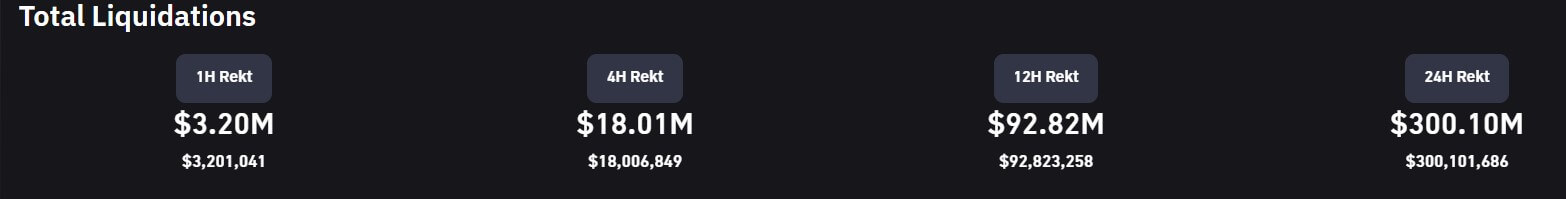

Across the broader crypto market, the total liquidations were $300.10 million over the last 24 hours, according to Coinglass data. The sell-off wiped off traders who took long positions on the market.

Most of the liquidations occurred on OKX, Binance, and ByBit. The three exchanges accounted for over 80% of the overall liquidations — of which 89% were long positions. Other exchanges like Huobi, CoinEx, and Bitmex also recorded a sizeable amount of the total liquidations.

According to Coinglass, 88,379 traders were liquidated — the most significant liquidation being a $3.92 million LTC-USDT long position on Binance.

Other liquidated assets include Ethereum (ETH) and Litecoin (LTC) — with $69.09 million and $12,20 million, respectively. Others like Dogecoin (DOGE) saw 12.49 million in liquidation, while Solana (SOL), Arbitrum (ARB), and XRP recorded less than $10 million each.

Bitcoin drops below $29,000

In the last 24 hours, the flagship digital asset fell to $28,953 at the time of writing, according to CryptoSlate data.

Bitcoin had a positive net flow of $28.3 million during the period. Glassnode data showed that while $775.6 million BTC was sent to crypto exchanges over the reporting period, investors withdrew $747.3 million as the bears took over the market.

Crypto analyst Maartun pointed out several headwinds in front of the industry that could pull it into a bear market. The analyst noted that a bunch of 7-10-year coins moved on-chain, which historically is not an excellent sign for the market.

The post $300M liquidated in Bitcoin’s descent below $29k appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/3Go7Abe

via IFTTT