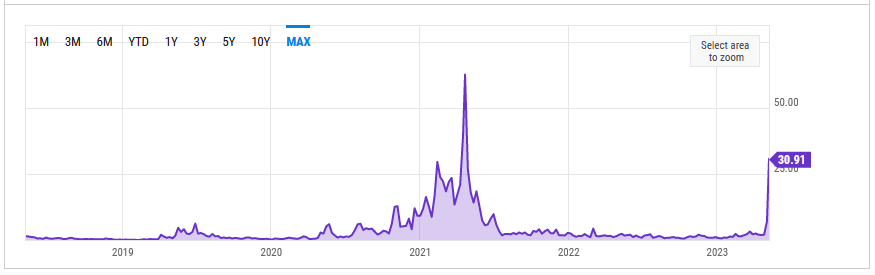

The average Bitcoin transaction fee has surged to $30.91 — a level not seen since April 2021, per data from ycharts.com.

The period in the run-up to April 2021 was characterized by a mania that saw Bitcoin run to $64,900 — likely driven by Coinbase’s NASDAQ listing and the narrative that crypto is going mainstream.

This run ended abruptly as China extended its anti-crypto policy to ban Proof-of-Work mining, followed by Elon Musk announcing Tesla would stop accepting BTC for vehicle purchases due to concerns over miners using fossil fuels.

Today, meme coin mania is driving activity on the Bitcoin network via the recently released BRC-20 standard.

What is BRC-20?

In March, the BRC-20 standard was created by an anonymous individual known as “Domo.”

While Bitcoin was traditionally a single-asset blockchain, the Ordinals protocol, via the Taproot soft fork, has enabled fungible BRC-20 assets to operate on the chain.

Taproot launched in November 2021 to make transactions quicker and cost-effective while laying the groundwork for smart contracts and dApps.

By February, Taproot’s capabilities were being used to store jpegs and videos directly on the blockchain, consequently creating a non-fungible market on Bitcoin — much to the annoyance of purists.

At the time, commentators warned that this would eventually lead to higher transaction fees and chain bloat – with BRC-20 added to the mix, that situation is playing out.

According to the brc-20.io website, BRC-20 tokens have a total market cap of $693.2 million. The top three tokens are Ordi, Nals, and Pepe —valued at $411.3 million, $42.3 million, and $34.7 million, respectively.

Scrolling the list shows tokens named d*ck, P*SY, sexy, and f*ck, indicating the general triviality of the BRC-20 space at this time.

Bitcoin casino

Despite this, echoing a comment from RamenPanda, foobar is adamant that BRC-20 tokens will be a significant factor in rising Bitcoin dominance, making Ethereum irrelevant.

“Next bull market will be driven by Bitcoin and BRC20 tokens

Bitcoin dominance will skyrocket to above 70%

Ethereum will become irrelevant.”

Similarly, Degen Spartan expressed a “can’t beat ’em, join ’em” attitude towards BRC-20 — saying if you’re going to memecoin, you might as well do it on Bitcoin.

“The eventual conclusion of the janky brc20 experiment will be that it is better to shitcoin on a chain purpose built to house and facilitate a full suite shitcoin casino.“

Willy Woo said there are pros and cons to the current situation. He explained that block rewards will be zero one day, meaning an alternative source of mining revenue is needed to keep miners incentivized.

At the same time, the trade-off is “bad for nodes and decentralisation” — adding that the impact of Ordinals is happening at a time when mining rewards are still high.

The post Bitcoin transaction fees surge to 24-month high amid BRC-20 memecoin mania appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/t17sSK4

via IFTTT