Quick Take

The implicit recognition of Bitcoin as a commodity by the Securities and Exchange Commission (SEC) marks a significant turning point for the digital asset. With the authorization of spot Bitcoin ETFs under NYSE Arca Rule 8.201-E, which governs Commodity-Based Trust Shares, Bitcoin has ascended to the status of the second largest commodity in the U.S. by assets under management (AUM).

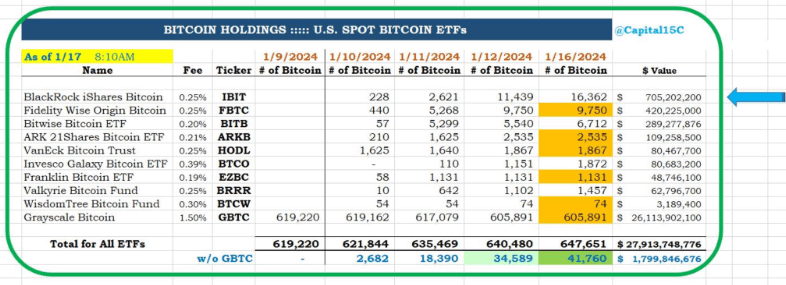

The landscape of Bitcoin ETFs has rapidly expanded to encompass several spot Bitcoin ETFs, amassing a combined value of $27.9 billion, according to Capital15C. Fundamentally, this value equates to 647,651 Bitcoin, of which Grayscale holds approximately 600,000. The conversion of Grayscale to a spot Bitcoin ETF essentially solidified Bitcoin’s position on its own.

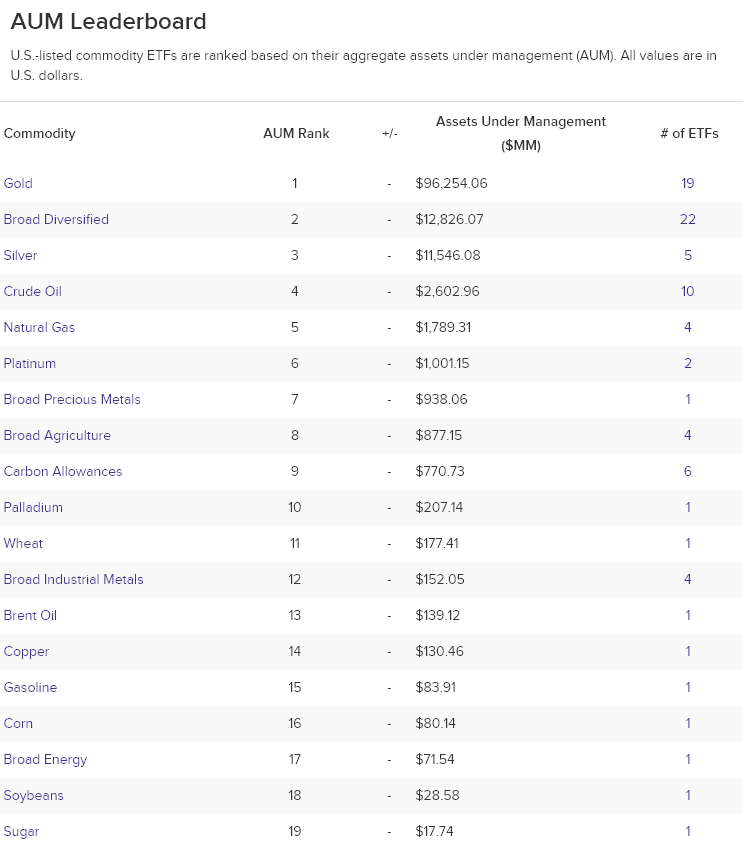

To put these figures in context, the ‘Broad Diversified’ asset class, previously the second-leading commodity in terms of assets under management (AUM), secures $12,826 billion across 22 ETFs. In third place, Silver trails with $11,546 billion held across 5 ETFs, according to etfdb.com.

The implicit recognition of Bitcoin as a commodity by the SEC demonstrates a noteworthy evolution in the perception and integration of digital assets in mainstream financial ethos. While Bitcoin is not currently present in the ETF list below, it would be ranked number 2 were it to be added in the future.

The post Bitcoin now second largest commodity ETF asset class in US, ahead of Silver appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/T9Hzvx1

via IFTTT