Bitcoin prices recovered past the $40,100 mark on Jan. 24, 2024 amidst continued inflows and outflows involving various spot Bitcoin ETFs.

Bitcoin (BTC) was up nearly 1% over the 24 hours ending at 11:55 p.m. UTC. on Wednesday, reporting a price of $40,143 and a market cap of $786 billion. During an earlier period that lasted about five hours, Bitcoin was worth less than $40,000, and it briefly fell as low as $39,563 at 9:00 pm.

The crypto market in its entirety is up 1.8% over 24 hours. Other leading assets have also seen gains: Solana (SOL) is up 5.8%, Dogecoin (DOGE) is up 1.2%, Avalanche (AVAX) is up 2.2%, and XRP is up 0.1%. Meanwhile, Ethereum (ETH) is down 0.2%, BNB is down 1.7%, and Cardano (ADA) has seen no change.

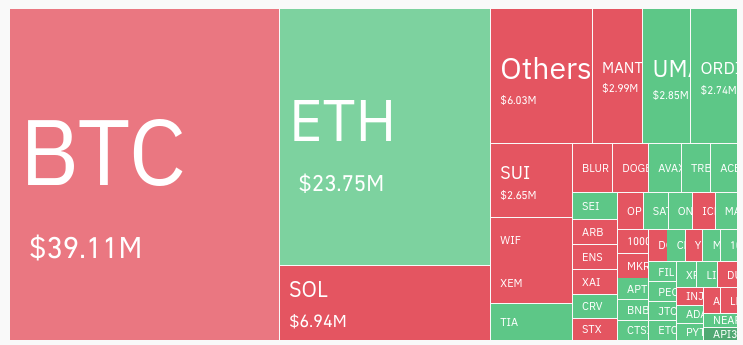

The market saw 37,063 trader liquidations worth $105.6 million in the 24 hour-period ending at 11:40 p.m., according to Coinglass. Of those liquidations, $39.11 million involved Bitcoin (BTC) and $23.75 million involved Ethereum (ETH).

GBTC outflows may affect prices

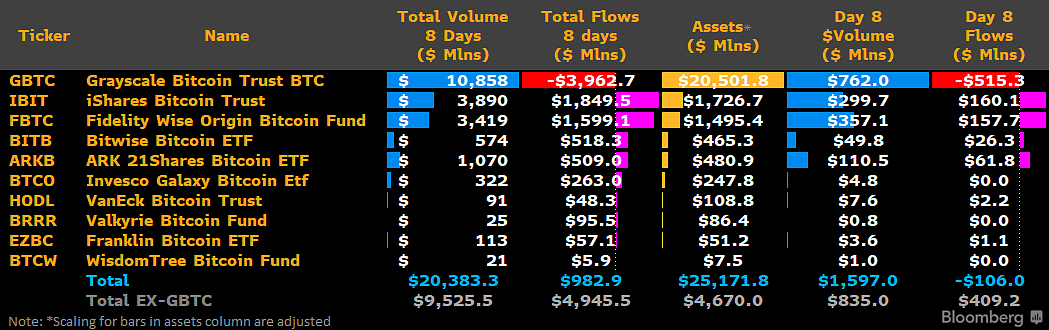

CryptoSlate Insights found that that GBTC outflows moved 19,236 BTC out of the fund on Jan. 23, an amount valued at more than $754 million.

GBTC outflows offset inflows into various other spot Bitcoin ETFs, a trend best seen in long-term data. Bloomberg ETF analyst James Seyffart reported that as of Jan. 23, GBTC has experienced $3.96 billion in cumulative outflows over 8 days, while other funds have seen $4.95 billion in inflows over the same period. This reduces overall spot Bitcoin inflows to just $982.9 million.

Any Bitcoin that enters and remains on the market is expected to increase the supply available to investors, thereby reducing prices.

Investor sentiment resulting from fading hype around spot Bitcoin ETFs may also impact prices alongside other developments.

The post Bitcoin recovers above $40k amidst GBTC outflows, other ETF inflows appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/CplYrjE

via IFTTT