Quick Take

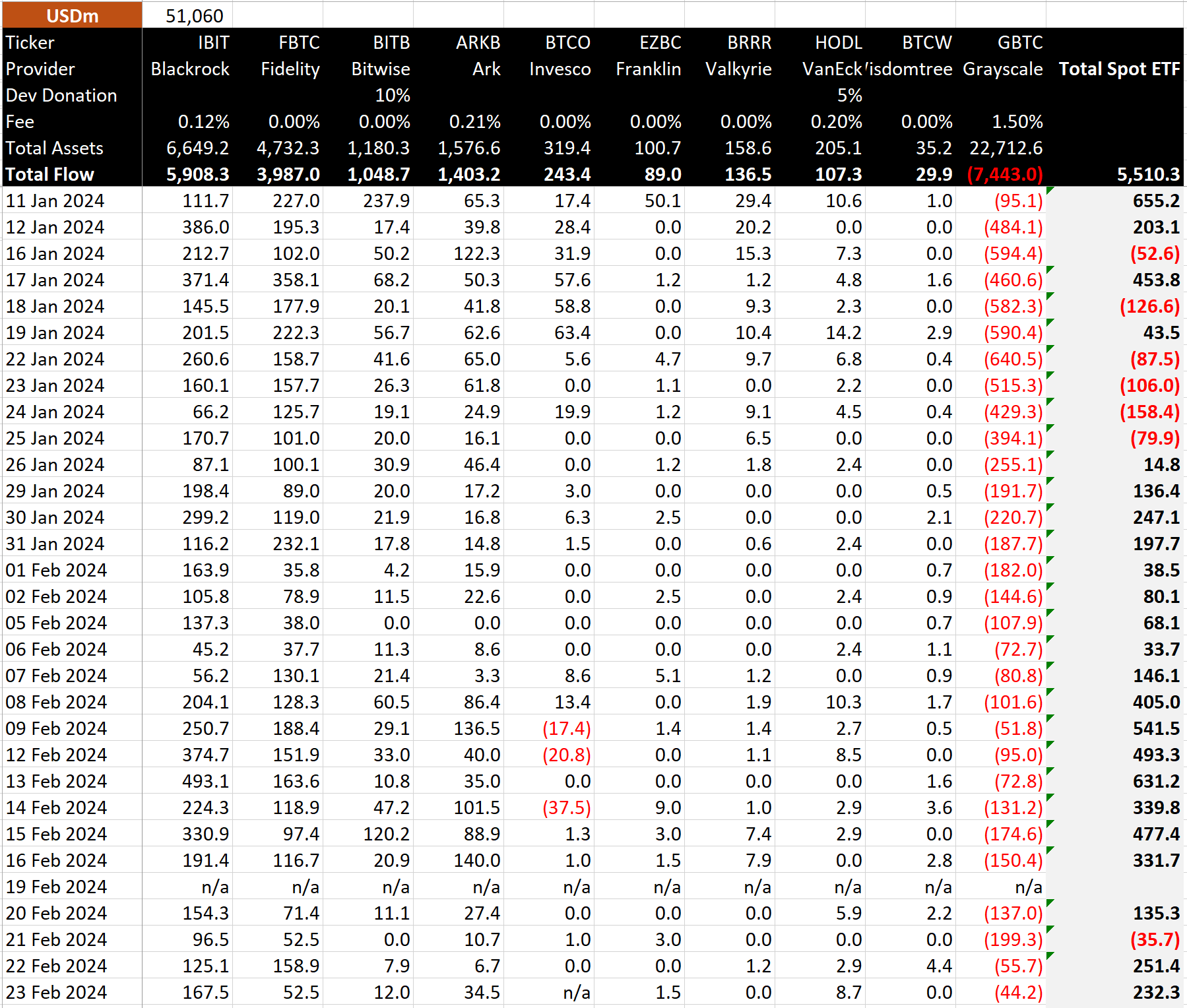

Bitcoin ETFs in the US have been an incredible success since their introduction on Jan. 11, as reported by CryptoSlate. In a notable development reported by BitMEX, the sector witnessed a strong inflow of $232 million on Feb. 23.

BitMEX data reveals the BlackRock IBIT ETF as the primary driver behind this continued uptick, accounting for $168 million of the total inflows and elevating its net flow to $6 billion. Meanwhile, the Grayscale Bitcoin Trust (GBTC) outflows presented a different narrative. The fund recorded its smallest outflow since the commencement of trading at $44 million, hinting at a potential slowdown in outflows. The day before, GBTC saw an outflow of $56 million, which brings the total outflows to $7.4 billion.

According to BitMEX, Invesco BTCO did not report any figures; however, Farside Investors confirmed that the ETF registered zero inflows or outflows.

The cumulative net inflows for spot ETFs have now hit the $5.5 billion mark, indicating substantial interest in these financial instruments, according to BitMEX.

The post GBTC records smallest outflow of $44 million since spot ETF conversion appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/F6YgiP3

via IFTTT