Quick Take

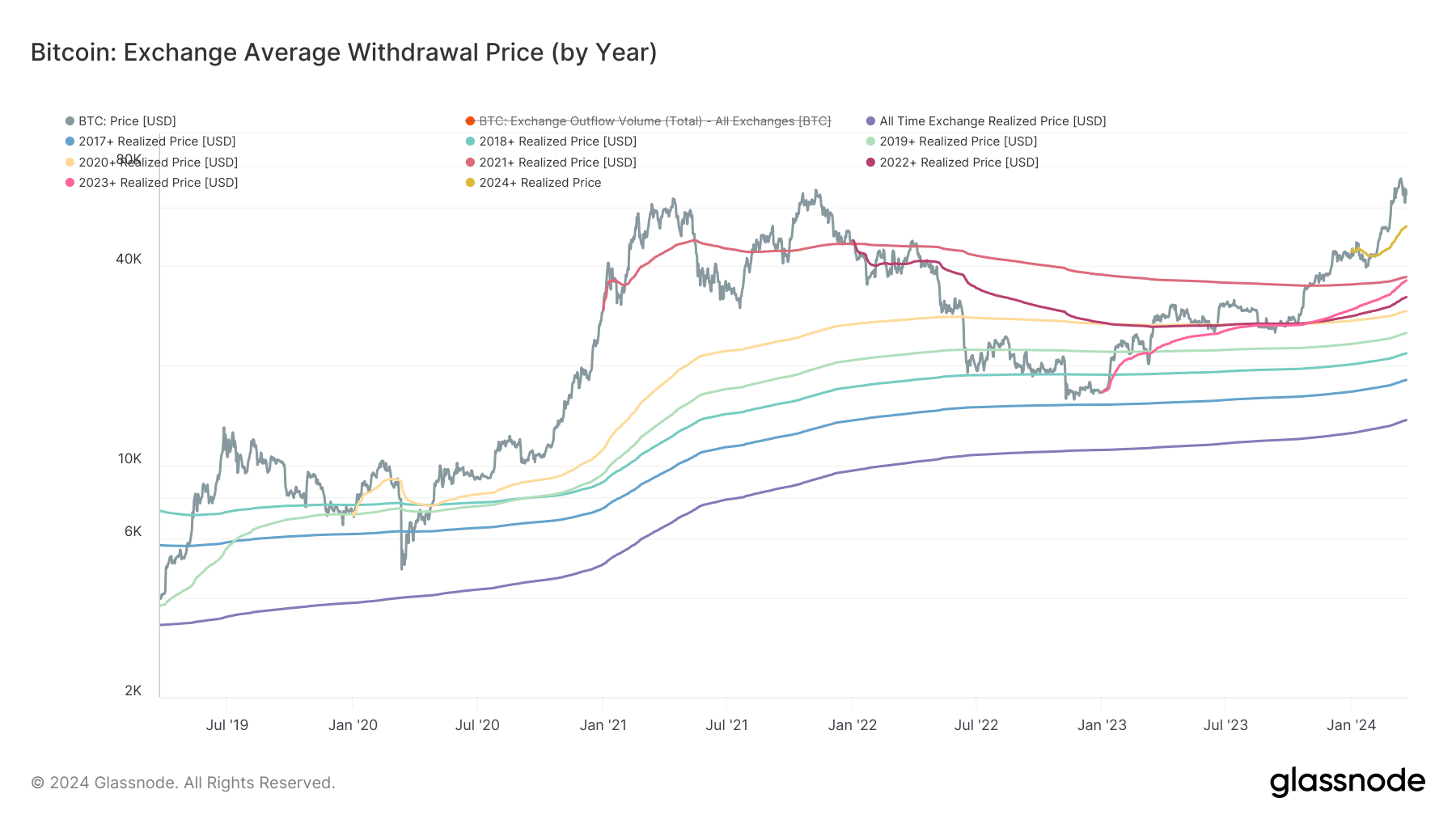

Utilizing data from Glassnode to estimate a market-wide cost basis reveals intriguing trends in the average price at which coins are withdrawn from exchanges. The information, segregated into cohorts, uncovers an upward trajectory on a cost basis, indicating a trend of purchasing Bitcoin at incrementally higher prices.

Most notably, the 2024 cohorts experienced a significant upswing, seeing an average profit margin of about $10,500, which translates to an approximately 20% gain from their initial cost basis ($52,478), according to data from Glassnode.

Interestingly, the 2021 cohort managed to significantly reduce their cost basis from $47,000 to a more conservative $36,971, as highlighted by recent CryptoSlate data analysis. Despite the reduction, the cost basis for all cohorts has risen in recent months, showing an unwavering dedication to buying Bitcoin regardless of increasing prices.

| Year | Price |

|---|---|

| All-time | $13,689 |

| 2017+ | $18,082 |

| 2018+ | $21,758 |

| 2019+ | $25,018 |

| 2020+ | $29,173 |

| 2021+ | $36,971 |

| 2022+ | $32,139 |

| 2023+ | $36,058 |

| 2024+ | $52,478 |

Source: Glassnode

The 2023 cohort, exhibiting the most bullish behavior, showcased a dramatic rise in cost basis from roughly $26,500 in October 2023 to a present figure of $36,058, suggesting a potential to surpass the 2021 cohort.

The post Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/z3EJi9V

via IFTTT